RSA – Employment Equity Statutory Changes

The following applies to South African companies who make use of the Equity Module.

The Minister of Employment and Labour published a new EEA4 form on 8 August 2019 in Government Gazette 42627.

The new EEA4 is effective from the date of publication and must be used for the 2018/2019 equity reporting year.

The main purpose of the new EEA4 form is to collect information for the establishment of norms and benchmarks to reduce the remuneration gap between the highest and lowest paid employees.

The new EEA4 Report should be used for the online submissions that are due in January 2020.

Section B

- The revised instructions on how to complete the existing and new sections.

- In summary, the revisions are made to the Remuneration, which is now split between fixed/guaranteed and variable remuneration and the inclusions.

Section C (Workforce Profile and Total Remuneration)

- Terminations are excluded.

New Section D (Fixed/Guaranteed and Variable Remuneration)

- Remuneration is split between fixed/guaranteed and variable

- Terminations and Temporary employees are excluded.

- Reports the employee with the highest remuneration in all occupational levels (except for the lowest occupational level) for each gender and race, but

- Reports the employee with the lowest remuneration in the lowest occupational level for each gender and race.

New Section E (Average and Median Remuneration and the Remuneration Gap)

- Terminations are excluded.

- Reports the average annual remuneration for the top 10% of the top earners, and

- the average annual remuneration for the bottom 10% of the bottom earners, and

- the remuneration for the median.

- Reports the vertical gap between the lowest and highest earner.

Please visit Sage City for all definitions and the exact breakdown of the EEA4 Report.

Steps to Update Equity Module

Equity Screens

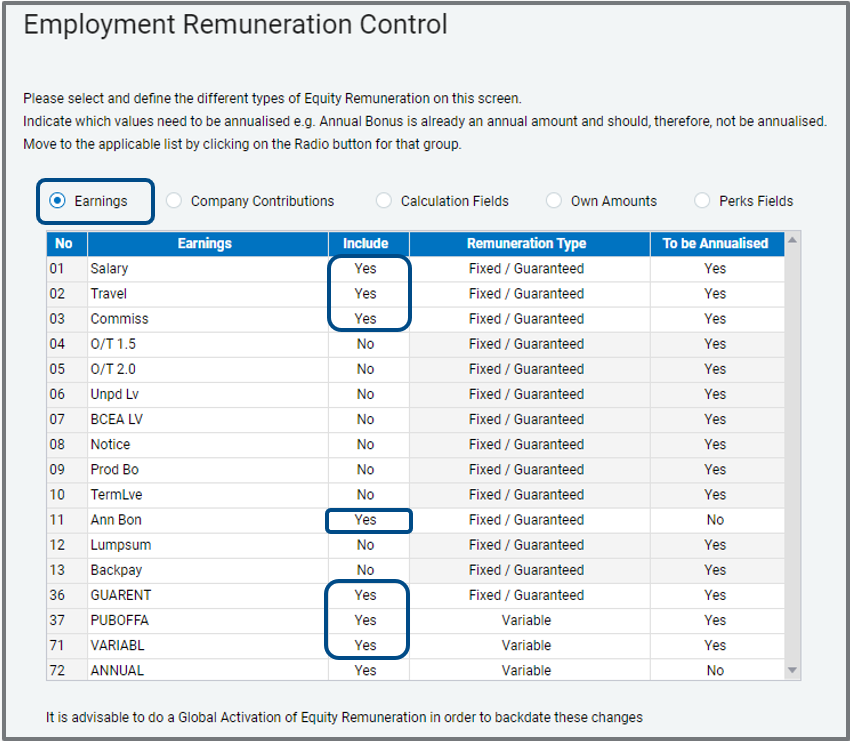

Main Menu > Equity > Equity Remuneration Control

All items that were previously set to ‘Yes’ on the Equity Remuneration Control Screen to be included in the equity remuneration calculation, will automatically be set to ‘Yes’ in this release.

Click on the radio button to display the applicable set of payroll lines.

The items previously set to ‘Yes’ are still set to ‘Yes’ in the Include column.

The rest of the columns on this grid are only enabled if the line is ‘included’.

Please refer to the statutory definitions of the new terms mentioned below on Sage City.

- Remuneration Type

This column defaults to ‘Fixed / Guaranteed’.

If this line is ‘Variable’ remuneration, according to the definition found on EEA4 Section B, please change it accordingly.

- To be Annualised

This column defaults to ‘Yes’.

‘No’ – If the values for the 12-month period must be used as is on the Equity Reports e.g. Annual Bonus which is already an annual value.

‘Yes’ - If the employee did not work for a full equity year (October to September), e.g. new employees, then the selected remuneration for the 12-month period will be annualised when printing the reports, according to the number of calendar days worked in the equity year.

The <Reset to BCEA Settings> has been removed.

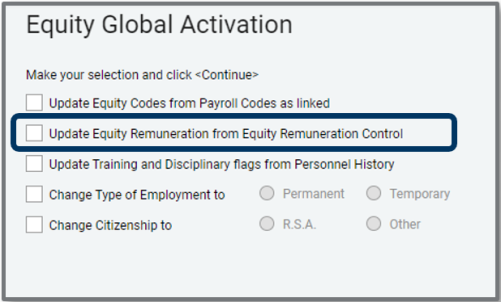

Main Menu > Equity > Equity Global Activation

The format of this screen has not been changed, however, when you select

‘Update Equity Remuneration from Equity Remuneration Control?’

the system will now allocate the values to the applicable four possible positions on the Employee Equity History Screen.

A recalculation is performed when you exit this screen.

Equity > Employee Equity Information

The Equity Remuneration has been modified on this screen to accommodate the changes.

The single value for Equity Remuneration has been broken down into 4 values, as linked on the Employment Remuneration Control Screen.

- Fixed / Guaranteed (To be Annualised)

- Fixed / Guaranteed (Annual Value)

- Variable (To be Annualised)

- Variable (Annual Value)

The values for the current period are displayed here. The values are truncated so no cents are displayed.

In a Non-monthly company, month-to-date (including current period) values will display.

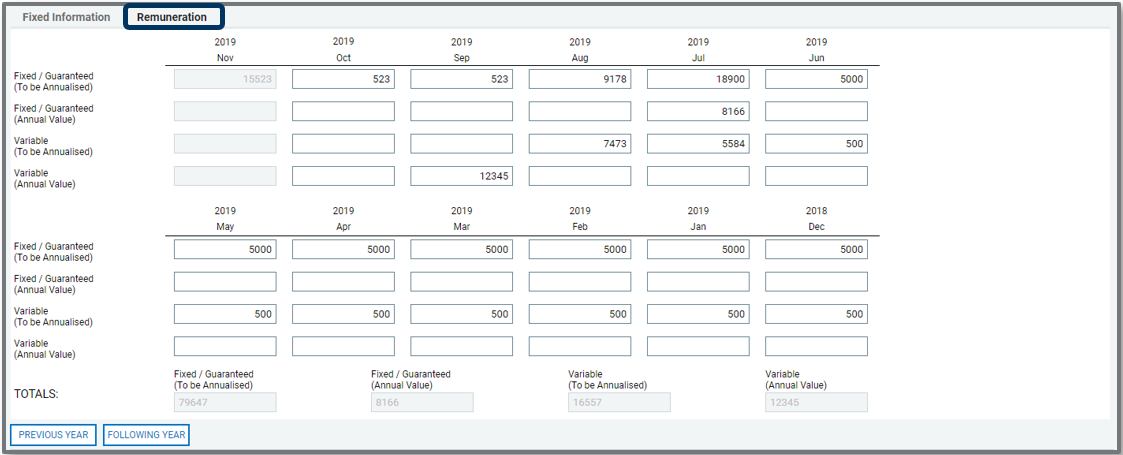

Main Menu > Equity > Employee Equity History Information

We have changed the Employee Equity History Information Screen completely to accommodate the additional information, by splitting the content over two tabs.

The first tab is the Fixed Information and displays the top half of the screen prior to this release.

The second tab displays the Remuneration as it is split between the four possible values as defined on the Equity Remuneration Control Screen.

Fixed Information Tab

Remuneration Tab

- Fixed/Guaranteed (to be Annualised): Values reflect per month but will be annualised on the report, based on the number of days worked in the equity year.

- Fixed/Guaranteed (Annual Value): Values reflect per month, but this is already an annual value and will not be annualised on the report.

- Variable (To be Annualised): Values reflect per month but will be annualised on the report, based on the number of days worked in the equity year.

- Variable (Annual Value): Values reflect per month, but this is already an annual value and will not be annualised on the report.

There may be discrepancies between the values on the Employee HS Screen and the values that are pulled through to the Equity History Screen in non-monthly companies.

This is due to the two screens allocating the number of weeks per month differently. However, the year-to-date values mostly work out to the same value.

Equity History Import

Main Menu > Interfaces > Import Data > Utility Imports > Equity History

The Equity History Import has been amended to cater for the distinction between Fixed / Guaranteed and Variable Equity Remuneration.

Please refer to the <Guidelines> for details concerning the layout change.

Equity Reports – EEA4

Main Menu > Equity > Employment Equity Reports

Before printing Equity Reports it is always a good idea to do a General Recalculation for Equity:

Main Menu > Equity > Equity General Recalc

A summary of the changes to the Equity Report follows together with examples of how the values are calculated.

The Equity report will not merge to the Word templates of the Labour Department.

The reports are all rendered as worksheets in an Excel workbook.

The EEA4 no longer includes terminations.

Summary of change:

|

Previous Equity Submissions |

Equity Submissions ending 15 January 2020

|

|---|---|

|

The EEA4 automatically populated the number of employees, which were the total of: |

The EEA4 will automatically populate the number of employees, which is now the total of: |

|

+ EEA2 Section B: Table 1.1 (workforce profile) – active employees |

+ EEA2 Section B: Table 1.1 (workforce profile) – active employees |

|

+ EEA2 Section C: Table 4.1 (terminations) – terminated employees |

|

- The equity fixed information and remuneration is recorded monthly on the Employee Equity History Screen. The Equity Report EEA4 uses the end date stated at print time to determine the 12-month period.

- The values recorded monthly on the Fixed / Guaranteed (To be Annualised) and Variable (To be Annualised) fields for the 12-month period are added together.

- This total value is annualised by dividing the value by the number of days worked in this 12-month period (equity year) multiplied by 365.

- The values recorded on the Fixed / Guaranteed (Annual Value) and Variable (Annual Value) fields are added to this total to determine the Equity Remuneration for this 12-month period (equity year).

Please see the Statutory definition of Fixed / Guaranteed and Variable Remuneration on Sage City.

Employee was active and in employment from: 1 October 2018 to 30 September 2019

|

Payroll Item |

12 Months Actual Value |

Fixed / Guaranteed (To be Annualised) |

Fixed / Guaranteed (Annual Value) |

Variable (To be Annualised) |

Variable (Annual Value) |

|---|---|---|---|---|---|

|

Salary |

120 000 |

120 000 |

|

|

|

|

Bonus |

10 000 |

|

10 000 |

|

|

|

Commission |

12 000 |

|

|

|

12 000 |

|

Overtime |

7000 |

|

|

7000 |

|

Total Values to be Annualised:

Fixed Guaranteed + Variable 120 000 + 7 000 = 127 000

Total Annual Values:

Fixed/Guaranteed + Variable 10 000 + 12 000 = 22 000

Calculation of Values for Income Differential (EEA4)

(Total of Values to be Annualised / number of days worked in the equity year x 365)

+ Total of Annual Values

(127 000 / 365 x 365) + 22 000 = 149 000

Employee was active and in employment from: 15 January 2019 to 30 September 2019

|

Payroll Item |

12 Months Actual Value |

Fixed / Guaranteed(To be Annualised) |

Fixed / Guaranteed (Annual Value) |

Variable (To be Annualised) |

Variable (Annual Value) |

|---|---|---|---|---|---|

|

Salary |

120 000 |

120 000 |

|

|

|

|

Bonus |

10 000 |

|

10 000 |

|

|

|

Commission |

12 000 |

|

|

|

12 000 |

|

Overtime |

7000 |

|

|

7000 |

|

Total of Values to be Annualised:

Fixed Guaranteed + Variable 120 000 + 7 000 = 127 000

Total of Annual Values:

Fixed/Guaranteed + Variable 10 000 + 12 000 = 22 000

Number of Days worked in the Equity year: 259

Calculation of Values for Income Differential (EEA4)

(Total of Values to be Annualised / number of days worked in the year x 365)

+ Total of Annual Values

(127 000 / 259 x 365) + 22 000 = 200 976.83 rounded up to 200 977

Days worked are calendar days. Days in Equity Year are always 365, irrespective of pay period e.g. monthly, weekly, etc.

This is a new section in EEA4.

Since this section is part of EEA4, it excludes terminations. This section also excludes temporary employees.

(See Statutory definition of temporary employees on Sage City.)

Section D records:

- the remuneration of the employee with the highest total remuneration in terms of population group and gender for all the occupational levels,

- except for the lowest occupational level in your organisation. Here the remuneration of the employee with the lowest total remuneration in your organisation in terms of population group and gender is recorded.

- The remuneration is first split between:

- Fixed / Guaranteed (To be Annualised) plus Fixed / Guaranteed (Annual Value)

- Variable (To be Annualised) plus Variable (Annual Value)

- Total Remuneration

- Where a choice had to be made between two employees with the same Total Remuneration, the employee with the higher VariableRemuneration is recorded,

- except at the lowest occupational level. Here the employee with the lowest Variable Remuneration is recorded.

This is a new section. Since this section is part of EEA4, it excludes terminations.

Section E records:

- the average annual remuneration of the top 10 % of the top earners in the organisation.

- the average annual remuneration of the bottom 10% of the bottom earners in the organisation.

Example of Calculation:

| Total employees | 19 |

| 10 % | 1.9 employees |

| Round up | 2 employees |

| Total Remuneration of the: | |

|

|

|

|

= Total average annual remuneration of top 10% of top earners |

|

|

|

|

| = Total average annual remuneration of bottom 10% of bottom earners | |

- the median earner’s remuneration in the organisation. (The median is the middle value in a list of payments, i.e. Equity Remuneration ranked from the lowest to the highest).

- The employer must indicate whether they have a policy in place to address and close the vertical gap between the highest and lowest paid employee in their workforce (Yes or No is indicated by an ‘X’ alongside the appropriate answer).

- The employer must indicate how many times (e.g. 10x, 15x, 20x) the vertical gap is between the highest and lowest paid employee in the organisation in terms of their policy.

- The employer must indicate if the remuneration-gap between the highest and lowest paid employees in their organisation aligns to their policy (Yes or No is indicated by an ‘X’ alongside the appropriate answer).

- The employer must indicate if there are AA measures to address the remuneration gap included in their EE plan (Yes or No is indicated by an ‘X’).

- The employer must select the key reason for the income differential that applies to their organisation.